us japan tax treaty social security

Article 71 of the United States- Japan Income Tax Treaty states that profits are taxable only in the Contracting State where the enterprise is situated unless the enterprise carries on business in the other Contracting State through a permanent establishment situated therein in which case the other Contracting State may tax the business profits but only so much of them as are. Exports and certain services to non-residents are taxed at a zero rate.

Social Security And Medicare Benefits For Immigrants Citizenpath

Technical Explanation PDF - 2003.

. This tax funds things like welfare health insurance workers compensation unemployment insurance and pension plans. Under the tax equalization arrangement the employer pays both the employees foreign Social Security tax of US7000 plus the employees foreign income tax. It helps many people who without the agreement would not be eligible for monthly retirement disability or survivors benefits under the Social Security system of one or both countries.

Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income PDF 2013. United States Treaties and Other International Agreements UST. Non-residents do not have to pay into Social Security.

32 rows Foreign Social Security Tax Rate. 3 Pensions and other income Most pension distributions are considered taxable income in both countries other than from certain qualifying plans such as. Usually expats pay taxes into the Japanese Social Insurance system after they start employment with any Japanese company.

Workers and their employers about 632 million in Japanese social security and health insurance taxes over the first 5 years of the agreement. An agreement with Japan would save US. Employee--US7000 Foreign Marginal Personal Income Tax Rate.

Formal negotiations to replace the current tax treaty between the two countries began in October 2001. 1 JANUARY 1973. It is in place to help relieve double taxation of dual citizens.

And Social Security Payments Article 24-----Diplomatic and Consular Officers Article 25-----Mutual Agreement Procedure. Income tax under a tax treaty you may be able to eliminate or reduce the amount of tax withheld from your wages. Expats on temporary assignments must pay into the US Social Security system too.

US Taxation of Japanese Social Security Pension On a yearly basis 70 of your pension plan distributions are taxable 7000 taxable amount divided by 10000 gross amount So 70 of the 1666 amount received in 2020 would be. The purpose of the treaty is to provide clarity for certain tax rules impacting citizens and residents of either country on matters involving cross-border income. You would list the foreign SS benefits on line 16a and 16b of the Federal 1040 form.

It helps many people who without the agreement would not be eligible for monthly retirement disability or survivors benefits under the Social Security system of one or both countries. The United States and Japan entered into a bilateral international income tax treaty several years ago. The Japanese-US tax treaty provides that SS benefits by either country are only taxed by the country of residence.

Social Security in Japan. The tax treaty serves to benefit citizens and residents from Japan who reside in the United States and vice-versa. As of 1 April 2014 the applicable rate is 8 previously 5.

Workers who have worked in both countries but not long enough in one or both countries to qualify for benefits. UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28. For example Switzerland requires 1 year Hungary requires 20 years and Japan requires 25 years SSA 2016 2017.

The two governments now are moving forward as quickly as possible to formal. If a US citizen runs a business they may have to pay self-employment taxes which do contribute to Social Security it is possible the US-Japan tax treaty means that people can choose to pay Japanese taxes instead. Clear that for treaty purposes the residences of the partners are relevant with respect to income.

It is possible the US-Japan tax treaty means that people can choose to pay Japanese taxes instead much cheaper. In fact if they work for a non-US employer abroad they are not allowed to pay in voluntarily. When it comes to the United States and the international tax treaties one of the main purposes behind the tax treaty is to help Taxpayers identify how certain income will be taxed by the IRS or Japan National Tax Agency depending on if the income is sourced.

The country that receives the tax payment is usually determined by the taxpayers resident status in each country. An Income Tax Treaty like the income tax treaty between Japan and the United States is designed to. Provide your employer with a properly completed Form 8233 for the tax year.

7000 multiplied by 72 5040. Protocol PDF - 2003. Here is a link to Japan-US tax treaty social security benefits covered in Article 23.

Us Japan Tax Treaty Social Security Get link. As of 1 October 2019 the rate will increase to 10 for certain foods drinks and newspapers the tax rate will remain as 8. The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan.

An agreement would also fill the gaps in benefit protection for US. Pension is a key ingredient in any tax treaty. If you are not a student trainee teacher or researcher but you perform services as an employee and your pay is exempt from US.

The Treasury Department announced today that the United States and Japan have reached an agreement in principle on the text of a new income tax treaty. Social Security in Japan. The US Japan tax treaty is useful for defining the terms for situations when it is unclear to which country taxes should be paid.

Japanese Pension Income Under USJapan Taxation Treaty. An agreement effective October 1 2005 between the United States and Japan improves Social Security protection for people who work or have worked in both countries. 1000000 - 650000 350000.

International Agreements US Tax Treaties between the United States and foreign countries have existed for many years and the US Japan Tax Treaty is no different. The US-Japan tax treaty was one of the first international tax treaties that the US signed. Income Tax Treaty PDF - 2003.

The US-Japan Social Security Agreement which went into effect October 1 2005 improves Social Security protection for people who work or have worked in both countries. Up to 85 of US Social Security payments may be considered taxable income in both the US as well as in Japan. The Form 8233 must report your Taxpayer Identification.

I would like to know where to report this on Form 1040. Accordingly Western European countries began to conclude bilateral treaties that would clarify social security tax liability and protect workers benefit rights.

Do Us Expats Have To Pay Social Security Tax Us Tax Help

Australia Tax Income Taxes In Australia Tax Foundation

Social Security Benefits For Noncitizens Everycrsreport Com

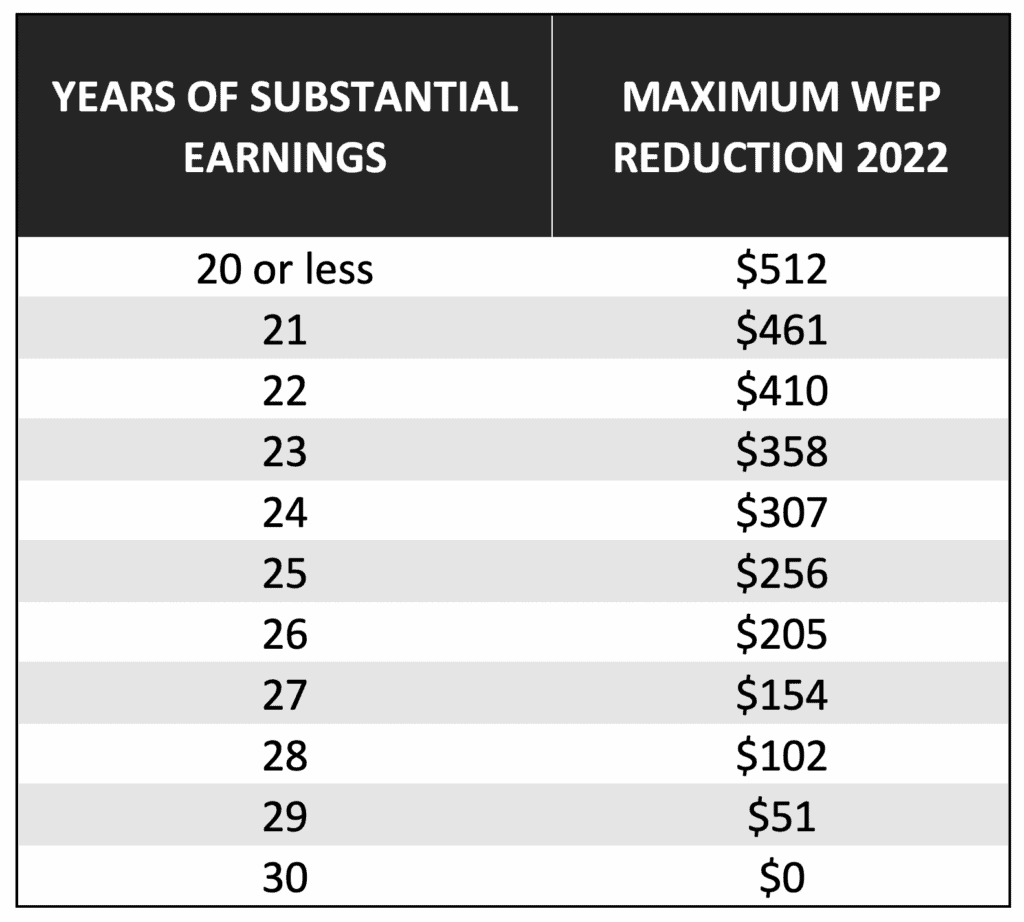

The Best Explanation Of The Windfall Elimination Provision 2022 Update Social Security Intelligence

Social Security Totalization Agreements

/hand-holding-a-social-security-check-142900507-0a20f4ec7f4c406a8249d28437f2731a.jpg)

Can You Still Receive Social Security If You Live Abroad

The Greater Tokyo Metropolis Japan

What Millennials Really Think About Social Security And Why They Might Not Be Entirely Wrong

Can You Still Receive Social Security If You Live Abroad

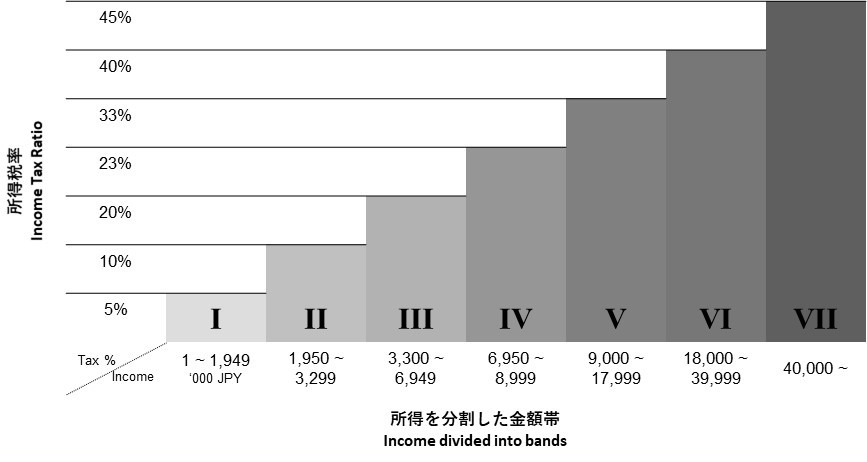

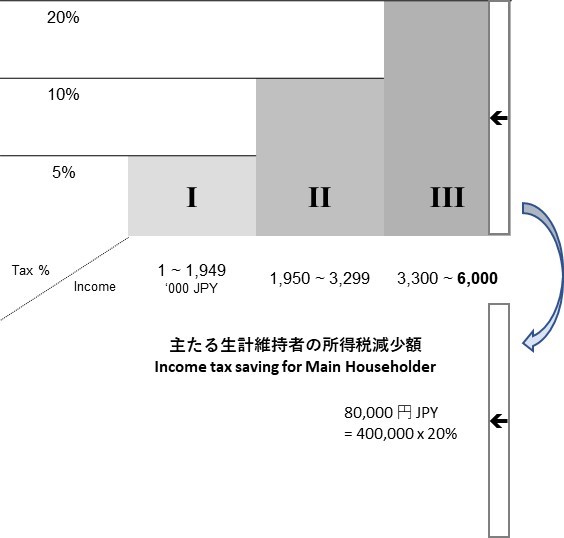

Social Security Tax Deduction For Social Insurance Premium Of Spouse Anshin Immigration Social Security

Easy Infographic Explains The Self Employment Tax For Americans Abroad

Do Expats Get Social Security Greenback Expat Tax Services

Social Security Name Change A Complete Guide For 2022 Marriage Name Change

Social Security Implications For Global Assignments Mercer

Social Security Implications For Global Assignments Mercer

Social Security Tax Deduction For Social Insurance Premium Of Spouse Anshin Immigration Social Security

Social Security Tax Deduction For Social Insurance Premium Of Spouse Anshin Immigration Social Security